Weekly Market Insights | March 17th, 2025

Rough Week for Stocks, with Slight Friday Rally

Investors endured another volatile, whipsaw week as ongoing trade talks and White House comments about the economy unsettled investors.

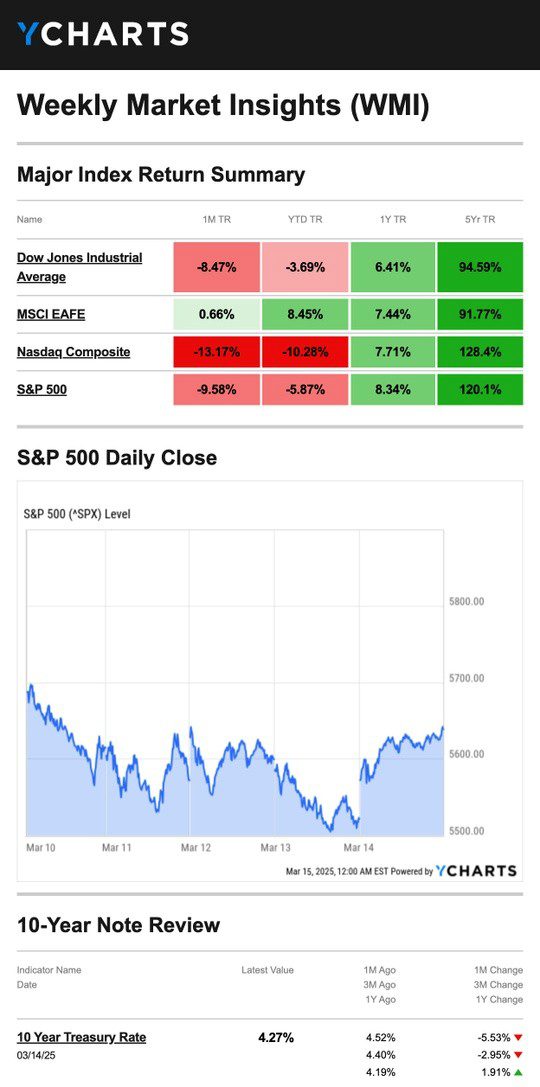

The Standard & Poor’s 500 Index declined 2.27 percent, while the Nasdaq Composite Index dropped 2.43 percent. The Dow Jones Industrial Average fell 3.07 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, lost 0.95 percent.1,2

Markets Stem Lossess

Stocks opened the week lower as investors reacted to the president’s weekend comments about the economy. Then, U.S. and Canadian leaders traded additional tariff threats, riling up anxious investors.3,4

Stocks rebounded midweek after a cooler-than-expected Consumer Price Index (CPI) report eased growing inflation concerns.5

The broad market slide resumed Thursday, but better-than-expected February wholesale inflation data helped buffer losses. The S&P 500 ended Thursday in correction territory—10 percent below its February 19 record close.6

Markets pushed higher Friday, clawing back some losses for the week. News of progress in resolving the federal government shutdown soothed investors’ nerves.7

Source: YCharts.com, March 15, 2025. Weekly performance is measured from Monday, March 10, to Friday, March 14. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Sunny Side ‘Down’

Fewer CPI constituents garner more attention from consumers right now than the price of eggs. Avian bird flu—and the subsequent culling of millions of chickens—was primarily to blame for prices rising 15 percent in January and another 10 percent in February. While recent evidence suggests prices have dropped, the cost of eggs remains a sticky issue—even though prices of many other items have risen just as much, if not more.8,9

So why do consumers appear to be overly uneasy?

One theory is that eggs symbolize something more significant. Not only are eggs a critical, inexpensive source of protein and nutrients for millions of consumers, but they are also a core part of many other foods made at home or mass-produced. For that reason, eggs are a mental proxy for how consumers believe the broader economy is doing.10

This Week: Key Economic Data

Monday: Retail Sales. Business Inventories. Homebuilder Confidence Index.

Tuesday: Housing Starts and Permits. Import & Export Prices. Industrial Production. Capacity Utilization. Federal Open Market Committee (FOMC) meeting—Day 1.

Wednesday: FOMC meeting—Day 2. Fed Announcement/ Fed Chair Press Conference.

Thursday: Existing Home Sales. Weekly Jobless Claims. Leading Indicators.

Friday: Federal Reserve Official John Williams speaks.

Source: Investors Business Daily – Econoday economic calendar; March 13, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: General Mills, Inc. (GIS)

Thursday: Nike, Inc. (NKE), Micron Technology, Inc. (MU), FedEx Corporation (FDX)

Source: Zacks, March 13, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“It takes 20 years to build a reputation and five minutes to ruin it.”

– Warren Buffett

Tax Tip…

If You Didn’t Receive Your W-2

If you don’t receive your W-2 or 1099 by January 31 of the year, you are filing taxes, or if the information on these forms is incorrect, contact your employer/payer. If you still haven’t received the forms you need by the end of February, you can contact the IRS at 800-829-1040, and they may be able to help.

When you contact the IRS, they will also reach out to the employer/payer for the information you need, and they will also send you Form 4852, a substitute for a W-2 or 1099. To do this, they will ask for your employer/payer’s name, address, and phone number (as well as your information).

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS11

Healthy Living Tip…

How to Make Hummus

Hummus is a dip made primarily from garbanzo beans and is great on pita bread, veggies, or chicken. Here’s how to make hummus:

- In a food processor or blender, combine ¼ cup tahini (sesame paste) with ¼ cup fresh lemon juice—process for one minute.

- Add 2 tablespoons olive oil, ½ teaspoon ground cumin, ½ teaspoon of salt, and 1 minced garlic clove to the mix and process until well-blended in 30-second increments (about a minute).

- Add half a can (¾ cup) of rinsed chickpeas and process for 1 minute. Then, add the other half of the can and process another 1-2 minutes.

- If your hummus still has bits of chickpeas, process it a bit more while slowly adding 2-3 tablespoons of cold water.

Tip adapted from Inspired Taste12

Weekly Riddle…

I twist, I turn, but I don’t have curves. You can twist me to fix me, but you may throw me into disarray in the process. Hours later, you may cast me away. What am I?

Last week’s riddle: What binds two people together yet touches only one person at a time?

Answer: An individual wedding ring.

Photo of The Week…

Lake Winnipesaukee in Autumn

New Hampshire, USA

Footnotes And Sources

1. The Wall Street Journal, March 14, 2025

2. Investing.com, March 14, 2025

3. The Wall Street Journal, March 10, 2025

4. CNBC.com, March 11, 2025

5. CNBC.com, March 12, 2025

6. CNBC.com, March 12, 2025

7. The Wall Street Journal, March 14, 2025

8. MarketWatch.com, March 12, 2025

9. Newsweek, March 11, 2025

10. MarketWatch.com, March 10, 2025

11. IRS.gov, April 3, 2024

12. Inspired Taste, October 3, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.